What is Copy

Trading?

GiC TradexCopy Trading allows you to find, follow and copy successful traders automatically. There is no need to build your own trading strategy or conduct research on forex markets. Copy trading removes the complexities of trading forex and CFDs. Find out how it works and take part in the largest financial markets in the world.

Copy Trading

with GiC Tradex?

The growing interest in Forex

Trading and Contracts For Difference (CFDs) has seen

the emergence of a new class

of traders that prefer to analyse the performance of

experienced traders and replicate their trading

behaviour.

Source - cache | Page ID - 1

Social Trading FAQ

What is the difference between a Copier and

Provider?

What is the difference between

a Copier and Provider?

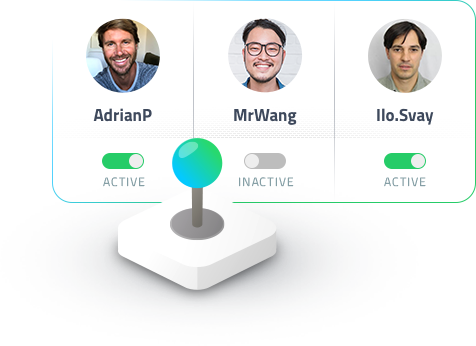

A 'Provider' is the person who's trading behaviour is being mirrored. Providers include successful traders who 'Offer' others the opportunity to copy their trades. A 'Copier' follows a 'Provider' using a copy trading system that automatically replicates their trading activity.

What is the best Social Trading platform?

What is the best Social

Trading platform?

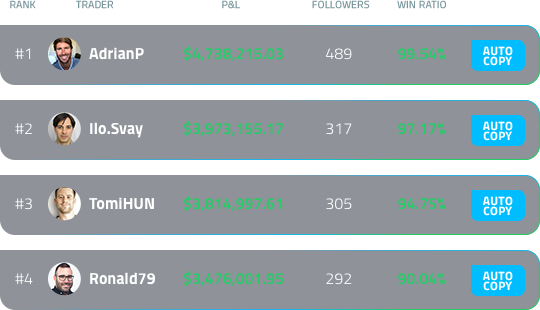

GiC Tradex Social Trading on MetaTrader 4 allows you to become a part of a community that shares in success. The copying system allows traders to choose from a variety of copying modes while the ratings module provides detailed performance statistics. The design of the interface is informative courtesy of transparent dynamic charts and tables. Discover our range of account types and start social trading with GIC Tradex today.

What is Social Trading in forex?

What is Social Trading

in forex?

Social trading in forex involves the process of learning about the trading strategies of experienced traders and analysing their performance using a wide range of statistical data. Social traders also have the option of replicating the trading behaviour of other traders through a copy trading platform.

Like other forms of social media, users can seek help or share their trading information with others. Social trading helps inexperienced traders become familiar with new concepts such as derivatives trading and leverage.

To learn more about forex trading, visit our Traders Hub Blog.

How do I set up my Social Trading account?

How do I set up my Social

Trading account?

Social trading with be done in a four easy steps:

Open a trading account

Go to the Ratings Page and follow a Provider

Login using your MetaTrader 4 credentials

Start copy trading

Can you make money from Social Trading?

Can you make money from

Social Trading?

Just like other forms of trading, you can make profits and losses from social trading. One of the benefits of Social Trading is that the performance of the listed traders is completely transparent. Their historical trades and trading statistics are updated in real-time to ensure that the information provided is accurate.

Anyone interested in social trading should consider their financial situation, become familiar with a variety or risk management strategies, and read any disclaimers.

How do I become a social trader?

How do I become a social

trader?

Social trading can be an effective way for new traders to gain exposure to financial markets. They are able to copy the trading behaviour of successful traders and accelerate the learning process. Social trading can provide a good stepping stone but should be accompanied by additional research and knowledge.

Read our Beginners Guide To Forex Trading and become familiar with the concept of CFD Trading