Cryptocurrency CFD Trading

What Cryptocurrency CFD Trading and Cryptocurrency CFD Trading ?

Are you ready to be a part of the currency revolution? Cryptocurrency CFDs trading is an exciting space right now especially if you open a trading account with GIC Tradex which is one of the most popular Cryptocurrency CFD trading platforms where you can trade the top 5 most traded cryptocurrencies on the cryptocurrency market - Bitcoin, Ethereum, XRP (Ripple), Bitcoin Cash, and Litecoin.

Forex trading involves simultaneously buying and selling two currencies. For example, if you are buying the EUR/JPY, it means you’re buying EUR by selling JPY and if you’re selling the pair, you’re buying JPY by selling EUR.

Advancements in technology now allow investors to access the foreign exchange market via online brokers. This is done using forex trading platforms such as MetaTrader 4, MetaTrader 5 and Iress. Read more on How Do I Trade Forex?

The rise in online trading has paved the way for using CFD trading. These are leveraged products which allow traders to open a position with an initial investments that is only a fraction of the value of the full trade.

How Do Cryptocurrency

Work?

Are you ready to be a part of the currency revolution? Cryptocurrency CFDs trading is an exciting space right now especially if you open a trading account with GIC Tradex which is one of the most popular Cryptocurrency CFD trading platforms where you can trade the top 5 most traded cryptocurrencies on the cryptocurrency market - Bitcoin, Ethereum, XRP (Ripple), Bitcoin Cash, and Litecoin

The most popular forex market type is the spot forex market. In forex, spot trades involve the exchange of currency pairs electronically using an online trading platform. Other market types include the forward forex market and futures forex market.

There are 4 major trading sessions.

Trading cryptocurrencies via CFDs (Contracts for Difference) is a new way to trade this volatile market. And, you don’t even need to be an expert CFD trader on how to trade Bitcoin and other crypto CFDs. GIC Tradex offers cryptocurrency CFDs in major assets like Bitcoin, XRP (Ripple), Bitcoin Cash, Litecoin and Ethereum, for positions against the US Dollar and Australian Dollar.

What is a Base

and Quote Currency in Forex?

Currencies are denoted in 3lettered ISO codes. Examples of how major currencies are denoted are USD (US dollar), AUD (Australian dollar), EUR (Euro), JPY (yen) and GPB (British Pound).

A favourite among big banks like Santander and Bank of America, the Ripple network is the next generation real-time gross settlement system.

What Moves

the Forex Market?

There

are a number of factors that have an impact on the forex market. They can split

into two categories;

market participants and macroeconomic factors.

Market Participants

Super Banks: As it is decentralised, it is the world's largest banks that determine the exchange rate. Global banks such as Barclays, HSBC, Citi, JPMorgan and Deutsche Bank are among the biggest traders of forex.

International Companies: Large global corporations are involved in the foreign exchange market for the purpose of doing business. If an Australian-based company is selling products in the United States they will have to trade USD to AUD in order to return their income back home.

Retail Traders: Refers to individuals who trade their own money in order to make a profit. Easier access to the forex market through online brokers and advanced trading platforms has resulted in retail traders accounting for a growing proportion of the forex market.

Economic & Macroeconomic Factors

Central Banks: Macroeconomic statistics such as inflation have a significant impact on forex markets. Governments and central banks such as the Federal Reserve meet on a regular basis to evaluate the status of their respective economies, set interest rates and monetary policy - all of which have a direct impact on forex markets.

Capital Markets: The prices of stock, bond and commodity futures also have an influence on foreign exchange markets.

International Trade: Figures relating to the trade numbers of a country have an impact on the value of currency. Trade deficits and surpluses will be reflected by price movements in the forex market.

Politics: This is particularly the case around key political events such as elections and results in high levels of volatility in the forex market. This is evident by historical events such as Brexit in the United Kingdom and numerous presidential election campaigns in the United States.

How to Get Started with Forex Trading?

Take a look at these 4 steps to start trading Forex:

Step 1 |

Educate yourself

Learn all you can about the market. Understand how forex trading can benefit you and ascertain what time you can dedicate to it. Learn how to decipher market fundamentals and how to study charts.

Step 2 |

Find a Regulated Broker

A regulated or licensed broker will provide a certain level of protection and provide you the necessary tools to trade efficiently. Open an GIC Tradex demo account and access our educational materials and you can practice strategies in live market pricing, without risking capital.

Step 3 |

Open a Margin Account

Decide on your risk/reward profile. How much of your capital can you afford to lose while trading? Based on that, choose your leverage. When you are a beginner, it is a good idea to start low.

Step 4 | Choose Your Trading

Platform

Australian licensed brokers offer some of the best forex technologies. Your long-term trading success will depend on swift trade execution, minimum slippage, fund security and efficient technical analysis. Choose a platform like MT4 or MT5 that offers all these, while also allowing you to trade on mobile devices.

An Example of

Leverage CFD Trading

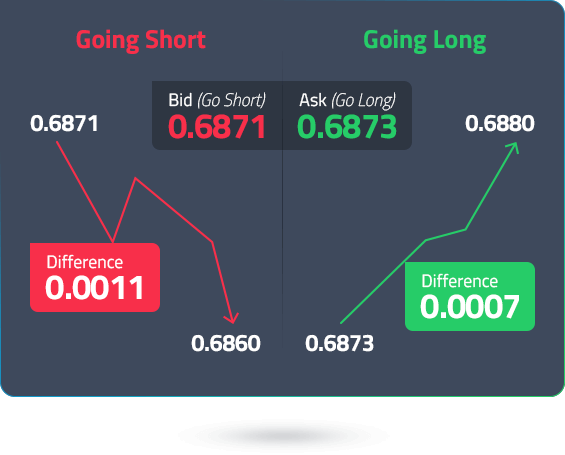

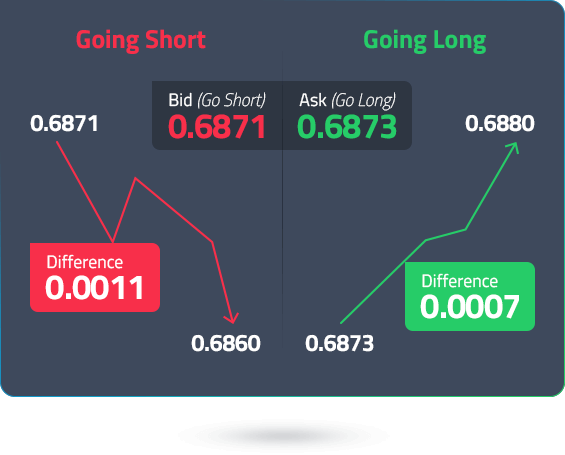

Suppose you want to trade CFDs, where the underlying asset is the AUD/USD currency pair, also known as the “Aussie.” Let us suppose that the AUD/USD pair is trading at:

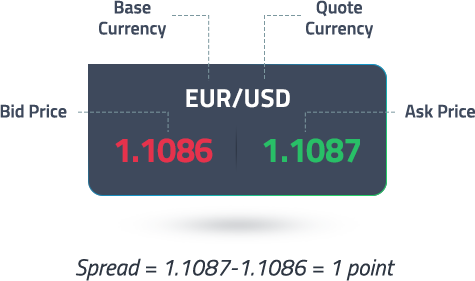

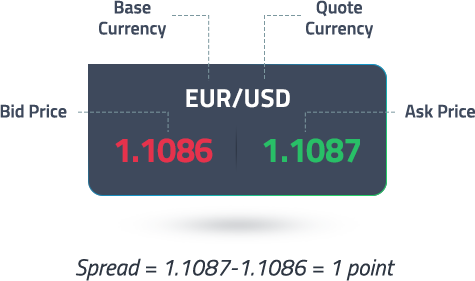

Bid/Ask Spread

Now, “bid” is the selling price. This is what you sell the asset at. The higher of the two is the “ask price” or buy price; the rate at which you buy the asset. The difference between these two prices is the “spread.” This is your cost of trading. Depending on how liquid your asset is and your choice of broker, the spread can be tight or wide. For instance, a broker can source quotes from a large pool of liquidity providers to offer you the tightest bid/ask spreads.

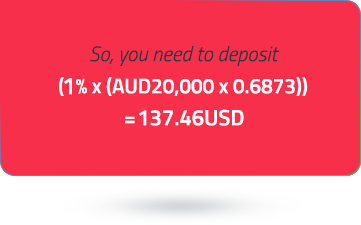

You decide to buy AUD 20,000 worth of USD because you think that the AUD/USD price will rise in the future. Your account leverage is set to 100:1. This means that you need to deposit 1% of the total position value into your margin account.

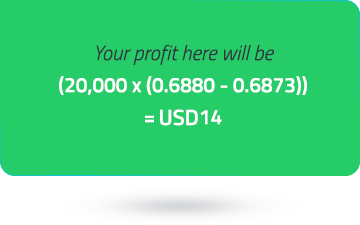

Now, in the next hour, if the price moves to 0.6880/0.6882, you have a winning trade. You could close your position by selling at the current price of USD 0.6880.

In this case, the price moved in your favour. But, had the price declined instead, moving against your prediction, you could have made a loss. If that loss resulted in your account equity falling below your margin requirements, your broker may issue a margin call.

Notice how a small difference in price can offer opportunities to trade? This small difference is known as “pip” or “percentage in point.” In the forex market, like in the above example, it is used to denote the smallest price increment in the price of a currency. For assets like the AUD/USD, which include the US Dollar, a pip is represented up to the 4th decimal place. But, in case of pairs that include the Japanese Yen, like the AUD/JPY, the quote is usually up to 3 decimal places.

This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In case your initial margin is lower, the broker will issue a margin call. If you fail to deposit the money, the contract will be closed at the current market price. This process is known as “marking to market.”

Crypto Majors, Minors and

Exotics

Not all currency pairs are traded in large volumes. The US Dollar, being the world’s reserve currency, is definitely traded the most; although, over the years, its dominance has waned somewhat. Based on how frequently they are traded, currency pairs are segregated into major, minor and exotic categories.

Majors

Major currency pairs have the tightest spreads.

They are:

EUR/USD

Euro/US Dollar (aka Fiber)

GBP/USD

British Pound/US Dollar (aka Cable)

USD/JPY

US Dollar/Japanese Yen (aka Ninja)

USD/CHF

US Dollar/Swiss Franc (aka Swissy)

CAD/USD

Canadian Dollar/US Dollar (aka Loonie)

AUD/USD

Australian Dollar/US Dollar (aka Aussie)

NZD/USD

New Zealand Dollar/US Dollar (aka Kiwi)

Minors

Then comes a category of minor currency pairs, otherwise known as cross-currency pairs. They are called so because they do not include the US Dollar. So, to convert one into the other, the US Dollar will need to act as a mediating currency.

A few of the minor pairs are:

EUR/GBP

Euro/British Pound (aka Chunnel)

EUR/AUD

Euro/Australian Dollar

CHF/JPY

Swiss Franc/Japanese Yen

GBP/JPY

British Pound/Japanese Yen (aka Gopher)

GBP/CAD

British Pound/Canadian Dollar.

Exotics

Exotics can include a major currency with an emerging market currency. Trading in exotics is considered risky, since they tend to have low liquidity, wider spreads and political instabilities in these countries can make these currencies volatile.

Some examples are:

EUR/TRY

Euro/Turkish Lira

USD/HKD

US Dollar/Hong Kong Dollar

AUD/MXN

Australian Dollar/Mexican Peso

In the brackets are the common nicknames for these currency pairs.

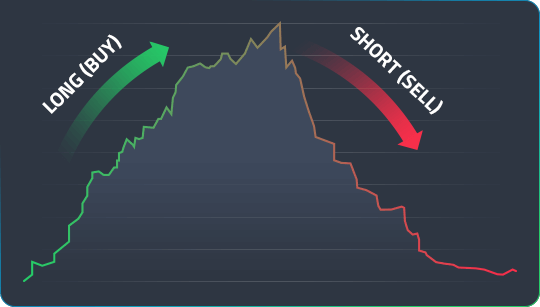

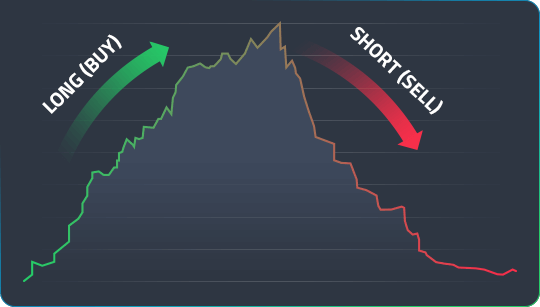

Going Long or Going

Short

When you assume a long position in a currency pair, you buy a currency in the hopes that its price will rise (appreciate) in the future. This means you wish to buy the base currency and sell the quote currency, since you expect the base currency to appreciate with respect to the quote currency.

When you assume a short position in a currency pair, you sell the base currency, expecting it to depreciate (decline in price) in the future, allowing you to buy it at a later date but at a lower price.

Lot Sizes

When you decide on your position size, a term you will hear is “lot.” Lots are standardised position sizes for currencies. The forex market gives you the flexibility to trade according to your means and risk profile. The standard size for a lot is 100,000 units of the base currency. There also are mini and micro lot sizes that contain 10,000 and 1,000 units of the base currency, respectively.

Source - cache | Page ID - 1