Forex Trading - A Beginner's Guide

What is Forex (FX) and How does Forex Trading Work?

Trading forex involves buying one currency and selling another simultaneously. Through careful analysis, traders predict the potential direction of currency prices and attempt to capture gains based on price fluctuations. There is no centralised exchange for forex trading. Rather, it takes place electronically or online, between networks of global computers. The market is open 24 hours a day, 5 days a week.

Forex trading involves simultaneously buying and selling two currencies. For example, if you are buying the EUR/JPY, it means you’re buying EUR by selling JPY and if you’re selling the pair, you’re buying JPY by selling EUR.

Advancements in technology now allow investors to access the foreign exchange market via online brokers. This is done using forex trading platforms such as MetaTrader 4, MetaTrader 5 and Iress. Read more on How Do I Trade Forex?

The rise in online trading has paved the way for using CFD trading. These are leveraged products which allow traders to open a position with an initial investments that is only a fraction of the value of the full trade.

How Do Forex Markets

Work?

Forex is the most popular over-the-counter (OTC) market. In forex, currencies are bought and sold through a network of banks. As there is no exchange, forex trading is decentralised and trading can take place 24 hours per day. There are 4 main trading sessions, namely Sydney, London, New York and Tokyo.

The most popular forex market type is the spot forex market. In forex, spot trades involve the exchange of currency pairs electronically using an online trading platform. Other market types include the forward forex market and futures forex market.

There are 4 major trading sessions.

Keep in mind that timings in some countries, like Australia, the US and UK, shift to/from daylight savings time in October/November and March/April. So, plan your trades accordingly. Market liquidity for currency pairs depends on the forex trading sessions. For instance, the EUR/USD pair shows a lot of movement and liquidity during the confluence of the London and New York sessions. The AUD/USD pair shows maximum movement in the Tokyo and London sessions. Once you know when to trade, the next step is to learn the jargon. So, here are some terms and concepts you will come across in the market.

What is a Base

and Quote Currency in Forex?

Currencies are denoted in 3lettered ISO codes. Examples of how major currencies are denoted are USD (US dollar), AUD (Australian dollar), EUR (Euro), JPY (yen) and GPB (British Pound).

In foreign currency trading, currencies are quoted in pairs. When you see a currency pair, the first currency is called the base currency and the second currency is the quote currency or counter currency. For instance, say the EUR/AUD is trading at 1.6163. This means to buy 1 unit of Euro, you will need $1.6163 Australian dollars.

What Moves

the Forex Market?

There

are a number of factors that have an impact on the forex market. They can split

into two categories;

market participants and macroeconomic factors.

Market Participants

Super Banks: As it is decentralised, it is the world's largest banks that determine the exchange rate. Global banks such as Barclays, HSBC, Citi, JPMorgan and Deutsche Bank are among the biggest traders of forex.

International Companies: Large global corporations are involved in the foreign exchange market for the purpose of doing business. If an Australian-based company is selling products in the United States they will have to trade USD to AUD in order to return their income back home.

Retail Traders: Refers to individuals who trade their own money in order to make a profit. Easier access to the forex market through online brokers and advanced trading platforms has resulted in retail traders accounting for a growing proportion of the forex market.

Economic & Macroeconomic Factors

Central Banks: Macroeconomic statistics such as inflation have a significant impact on forex markets. Governments and central banks such as the Federal Reserve meet on a regular basis to evaluate the status of their respective economies, set interest rates and monetary policy - all of which have a direct impact on forex markets.

Capital Markets: The prices of stock, bond and commodity futures also have an influence on foreign exchange markets.

International Trade: Figures relating to the trade numbers of a country have an impact on the value of currency. Trade deficits and surpluses will be reflected by price movements in the forex market.

Politics: This is particularly the case around key political events such as elections and results in high levels of volatility in the forex market. This is evident by historical events such as Brexit in the United Kingdom and numerous presidential election campaigns in the United States.

How to Get Started with Forex Trading?

Take a look at these 4 steps to start trading Forex:

Step 1 |

Educate yourself

Learn all you can about the market. Understand how forex trading can benefit you and ascertain what time you can dedicate to it. Learn how to decipher market fundamentals and how to study charts.

Step 2 |

Find a Regulated Broker

A regulated or licensed broker will provide a certain level of protection and provide you the necessary tools to trade efficiently. Open an GIC Tradex demo account and access our educational materials and you can practice strategies in live market pricing, without risking capital.

Step 3 |

Open a Margin Account

Decide on your risk/reward profile. How much of your capital can you afford to lose while trading? Based on that, choose your leverage. When you are a beginner, it is a good idea to start low.

Step 4 | Choose Your Trading

Platform

Australian licensed brokers offer some of the best forex technologies. Your long-term trading success will depend on swift trade execution, minimum slippage, fund security and efficient technical analysis. Choose a platform like MT4 or MT5 that offers all these, while also allowing you to trade on mobile devices.

A Brief

History

of Forex

The exchange of currencies dates back to 600BC when the first official currency was created. Fast forward to today and the forex market has become the largest financial market in the world. The timeline below highlights key moments in the journey of forex.

600

BC

Kingdom of Lydia introduces

coins made of gold and silver.

618

AD

Tang dynasty in China created

the paper note.

1661

AD

The first banknote ever printed

in Europe is produced in

Sweden.

17th

CENTURY

Amsterdam becomes home to

the first forex market ever

created.

1819

AD

England adopts the gold

standard with the government

guaranteeing to redeem any

amount of paper money for its

value in gold. The United

States

followed suit in 1834 before

other major countries (France,

Germany and

others) in 1870.

1946

AD

Following multiple World Wars,

the gold standard system

breaks down. It is replaced by

the Bretton Woods System.

The US Dollar is

established as

the world’s reserve currency.

1973

AD

Official switch to the free

floating system.

1996

AD

Birth of online brokers.

2005

AD

MetaTrader 4, a revolutionary

trading platform is released.

It

is specifically designed for forex

traders and features real-time

pricing.

Today

Daily forex turnover figures

exceed more than $5 trillion per

day.

Forex Quotes /

Exchange Rates

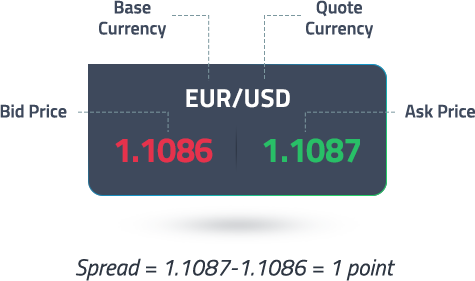

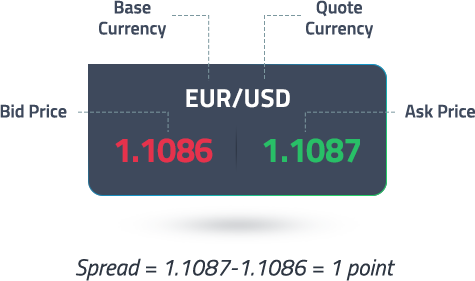

Currencies are traded in pairs, like the Euro/US Dollar (EUR/USD) or Australian Dollar/US Dollar (AUD/USD). Currencies are denoted in 3-lettered ISO codes, such as EUR (Euro), GBP (Great British Pound) and USD (US Dollar). When you see a currency quote, the first currency is called the base currency and the second currency is the quote currency or counter currency. For instance, say the EUR/USD is trading at 1.1086. This means to buy 1 unit of Euro, you will need $1.1086. USD

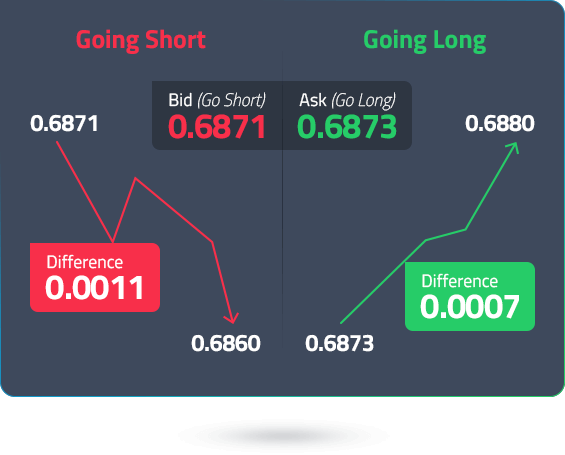

The higher price $1.1087 is the ask rate, while $1.1086 is the bid rate. The bid price is the maximum price a buyer is willing to pay for the currency. Ask price is the minimum price a seller is willing to accept for the same currency. These rates fluctuate constantly, depending on supply and demand, market sentiment and external events.

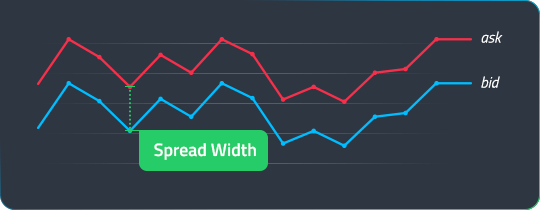

Spread

The difference between these two rates is known as the spread. This includes the broker’s charges. The spread depends on your choice of currency pair and the forex broker. Licensed forex brokers who provide ECN (Electronic Communications Network) pricing can source price quotes from multiple liquidity providers in the market. This means they can offer the tightest spreads.

An Example of

Leverage CFD Trading

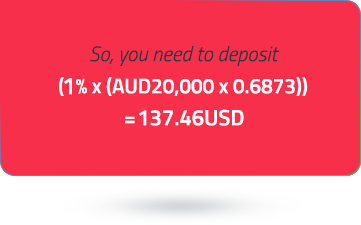

Suppose you want to trade CFDs, where the underlying asset is the AUD/USD currency pair, also known as the “Aussie.” Let us suppose that the AUD/USD pair is trading at:

Bid/Ask Spread

Now, “bid” is the selling price. This is what you sell the asset at. The higher of the two is the “ask price” or buy price; the rate at which you buy the asset. The difference between these two prices is the “spread.” This is your cost of trading. Depending on how liquid your asset is and your choice of broker, the spread can be tight or wide. For instance, a broker can source quotes from a large pool of liquidity providers to offer you the tightest bid/ask spreads.

You decide to buy AUD 20,000 worth of USD because you think that the AUD/USD price will rise in the future. Your account leverage is set to 100:1. This means that you need to deposit 1% of the total position value into your margin account.

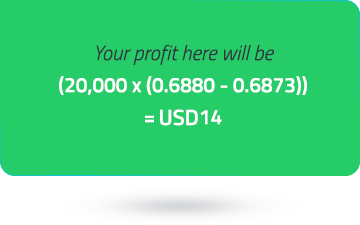

Now, in the next hour, if the price moves to 0.6880/0.6882, you have a winning trade. You could close your position by selling at the current price of USD 0.6880.

In this case, the price moved in your favour. But, had the price declined instead, moving against your prediction, you could have made a loss. If that loss resulted in your account equity falling below your margin requirements, your broker may issue a margin call.

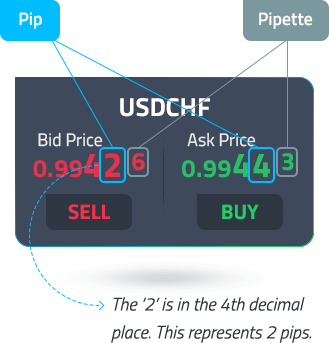

Notice how a small difference in price can offer opportunities to trade? This small difference is known as “pip” or “percentage in point.” In the forex market, like in the above example, it is used to denote the smallest price increment in the price of a currency. For assets like the AUD/USD, which include the US Dollar, a pip is represented up to the 4th decimal place. But, in case of pairs that include the Japanese Yen, like the AUD/JPY, the quote is usually up to 3 decimal places.

This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In case your initial margin is lower, the broker will issue a margin call. If you fail to deposit the money, the contract will be closed at the current market price. This process is known as “marking to market.”

What is Pip in Forex?

Pip is an acronym for Point in Percentage. It represents the smallest amount of change in the rate of a currency pair and is a standardised unit. For a US Dollar based currency pair, like the AUD/USD, one pip is $0.0001. However, for some currencies, like the Japanese Yen (JPY), it is denoted as $0.001.

Pip value fluctuations have an effect on trading gains. For example, if you decide to buy €10,000 and the EUR/USD pair is trading at 1.1086, the price you will have to pay will be $(10,000x1.1086) or $11,086.

If the exchange rate for this pair sees a 5-pip increase, which means the EUR/USD is now trading at 1.1091, then to buy €10,000, you will have to pay $11,091.

Forex Majors, Minors and

Exotics

Not all currency pairs are traded in large volumes. The US Dollar, being the world’s reserve currency, is definitely traded the most; although, over the years, its dominance has waned somewhat. Based on how frequently they are traded, currency pairs are segregated into major, minor and exotic categories.

Majors

Major currency pairs have the tightest spreads.

They are:

EUR/USD

Euro/US Dollar (aka Fiber)

GBP/USD

British Pound/US Dollar (aka Cable)

USD/JPY

US Dollar/Japanese Yen (aka Ninja)

USD/CHF

US Dollar/Swiss Franc (aka Swissy)

CAD/USD

Canadian Dollar/US Dollar (aka Loonie)

AUD/USD

Australian Dollar/US Dollar (aka Aussie)

NZD/USD

New Zealand Dollar/US Dollar (aka Kiwi)

Minors

Then comes a category of minor currency pairs, otherwise known as cross-currency pairs. They are called so because they do not include the US Dollar. So, to convert one into the other, the US Dollar will need to act as a mediating currency.

A few of the minor pairs are:

EUR/GBP

Euro/British Pound (aka Chunnel)

EUR/AUD

Euro/Australian Dollar

CHF/JPY

Swiss Franc/Japanese Yen

GBP/JPY

British Pound/Japanese Yen (aka Gopher)

GBP/CAD

British Pound/Canadian Dollar.

Exotics

Exotics can include a major currency with an emerging market currency. Trading in exotics is considered risky, since they tend to have low liquidity, wider spreads and political instabilities in these countries can make these currencies volatile.

Some examples are:

EUR/TRY

Euro/Turkish Lira

USD/HKD

US Dollar/Hong Kong Dollar

AUD/MXN

Australian Dollar/Mexican Peso

In the brackets are the common nicknames for these currency pairs.

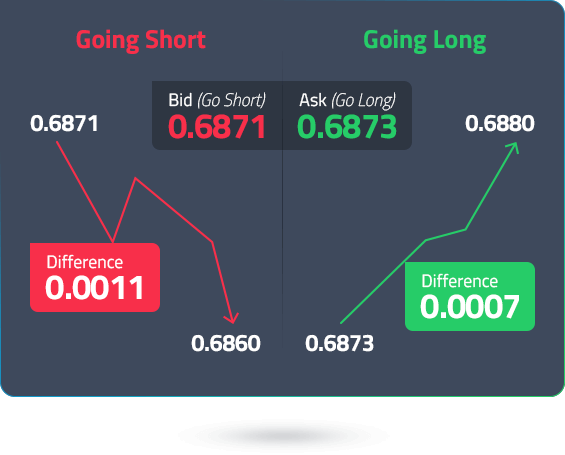

Going Long or Going

Short

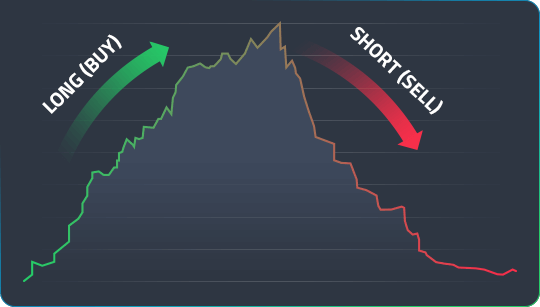

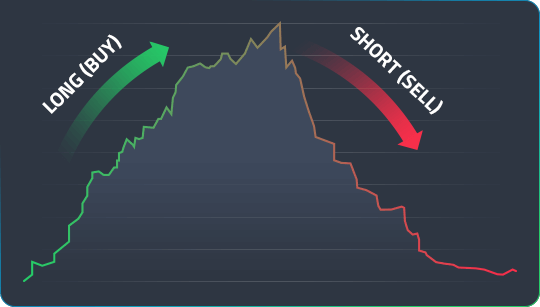

When you assume a long position in a currency pair, you buy a currency in the hopes that its price will rise (appreciate) in the future. This means you wish to buy the base currency and sell the quote currency, since you expect the base currency to appreciate with respect to the quote currency.

When you assume a short position in a currency pair, you sell the base currency, expecting it to depreciate (decline in price) in the future, allowing you to buy it at a later date but at a lower price.

Lot Sizes

When you decide on your position size, a term you will hear is “lot.” Lots are standardised position sizes for currencies. The forex market gives you the flexibility to trade according to your means and risk profile. The standard size for a lot is 100,000 units of the base currency. There also are mini and micro lot sizes that contain 10,000 and 1,000 units of the base currency, respectively.

Source - cache | Page ID - 1